Creating, investing in, or working for businesses with network effects is a formula for skewing the odds of success in your favor. This requires the ability to identify and understand network effects, including the various types and their implications. My goal is to provide a toolkit that enables investors and founders to analyze and understand network effects.

Thus far, we have explored what network effects are and how they work (part 1), as well as the various types of network effects (part 2). The last part of this series will be a case study on Facebook and Uber, two businesses built by network effects. We will look at their network effects and the lessons we can learn from them.

“I think that network effects shouldn’t be underestimated with [regard to] what we do.” – Mark Zuckerberg

Facebook’s network effects

Facebook is perhaps the best example of how powerful network effects can be from a value creation perspective. Facebook first raised outside money at a $5M valuation in 2004 and is currently worth ~$1T (an increase of ~200,000x).

Facebook’s core network effect is its personal direct network, and this is the network that is most visible to outsiders. But Facebook’s success can be attributed to the depth and variety of network effects that it has systematically built over time. [1]

Facebook has built four powerful network effects worth analyzing:

-

Personal direct

-

Personal utility

-

Data

-

2-Sided marketplace [2]

1. Personal direct networks

By allowing people to create online reputations and identities, Facebook created the most powerful personal direct network of all time. As Facebook usage increased (through new users or increased usage by existing users), the network became more valuable for all other participants. Eventually, Facebook’s personal direct network reached critical mass, resulting in people being less willing to defect to another network where they would have to build their community from scratch.

2. Personal utility

In 2011 Facebook launched Facebook Messenger and layered another network effect on top of its business. Facebook doubled down on its personal utility network with its $13B acquisition of WhatsApp in 2013.

These two products have been tremendously successful: WhatsApp has ~2B active users and Facebook Messenger has ~1.3B.

3. Data

Facebook has three distinct data network effects:

Content inventory: Users add more content (data) as usage grows, which gives Facebook more options for curating content for News Feed and other applications.

Engagement: Likes and comments give Facebook valuable information about the best content to share and spread.

Behavioral data adjustments: The combination of the two above-mentioned factors allows Facebook to make real-time upgrades to its products (e.g., News Feed & Instagram trends) to improve the value to users and create a positive feedback loop.

4. 2-Sided marketplace

Facebook has two distinct 2-sided marketplaces: a two-sided media marketplace and a two-sided online classifieds marketplace.

Two-sided media marketplace: Facebook’s media marketplace is core to its revenue model. The two sides consist of Facebook users (supply side) and advertisers (demand side). The model is so successful that it accounts for roughly a quarter of all online ad revenue in the US.

Online classifieds: Facebook Marketplace is essentially Facebook’s attempt to displace Craigslist. And it has a strong chance to do so given Facebook’s much larger network of users and higher transaction trust. Facebook Marketplace is often connected to user’s real names and identities, as opposed to Craigslist, which has anonymous classifieds.

Lessons from Facebook

Facebook is a great example of how a company can deliberately and methodically build numerous network effects to strengthen its competitive position. Facebook started out as a personal direct network and then added a 2-sided marketplace in ~2008, and a personal utility network in 2011 & 2013, all of which is underpinned by the platform’s data network effect.

What is most interesting is that while public sentiment regarding Facebook has shifted from positive to negative, the platform is stronger and more valuable than ever before. Network effects are at the root of this phenomenon.

For founders, the lesson is to constantly look for ways to incorporate different network effects into the companies they are building.

For investors, the lesson is to search for companies that have existing network effects that can act as platforms for additional network businesses. Providing guidance and capital to founders with this capability will skew the odds in their favor.

Uber

“[The] foundation of our platform is our massive network”- Uber S-1

Uber’s network effects:

Uber’s biggest asset is its network effect. The network effect most synonymous with Uber is its ride platform. However, Uber has built two additional network effects worth exploring, bringing its total to three:

-

2-Sided asymptotic marketplace (Rides)

-

3-Sided marketplace (Uber Eats)

-

Data [2]

1. 2-Sided asymptotic marketplace

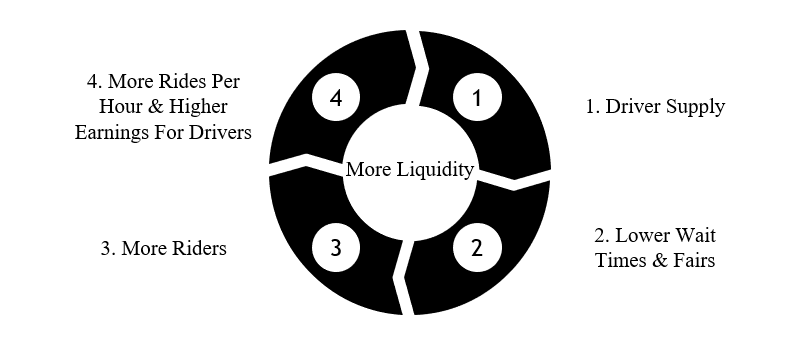

Uber’s core product is Rides, which is a 2-sided asymptotic marketplace. Uber describes its ride platform as a “liquidity network effect”.

From Uber’s S-1

In the diagram above, Uber shows how each new user adds value to all the other users (demand side and supply side). Its ride network effect has five stages, each leading to the next.

In theory, Uber’s ride framework should lead to a 2-sided marketplace, but in reality, Uber Rides is an asymptotic marketplace. Asymptotic marketplaces experience an initial value increase to the demand side from supply increases, but this value starts to diminish quickly (more on this in the next section).

2. 3-Sided marketplace

Uber has successfully built a 3-sided marketplace with Uber Eats. Uber Eats is comprised of drivers (supply), restaurants (supply), and users (demand).

While the food delivery space is highly competitive, Uber has access to a large supply network (drivers) through its ride platform. However, like Rides, Uber Eats is susceptible to multi-tenanting (more on this in the next section).

3. Data

Uber has strong data network effects across all of its products. The data they collect from each transaction allows Uber to improve demand predictions, matching, dispatching, pricing and routing. The more data Uber collects, the better all of its product lines become, leading to even higher usage.

Lessons from Uber

Uber provides two lessons for investors and founders:

-

Not all network effects are equal

-

Multi-tenanting may result in price competition

1. Not all network effects are equal

As previously mentioned, Uber’s ride business unit is not a true 2-sided marketplace—it is an asymptotic marketplace.

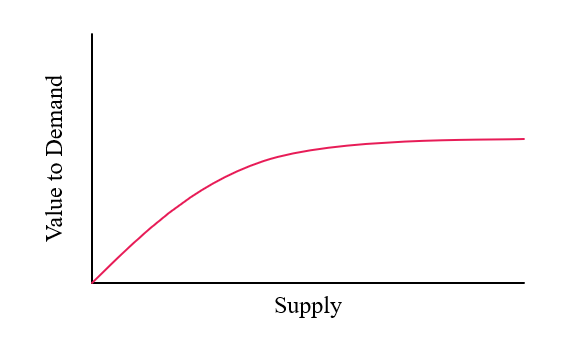

Asymptotic marketplaces experience an initial value increase to the demand side (riders) from an increase in the supply side (drivers). But this value quickly diminishes as supply increases.

In Uber’s case, increases in driver supply and rider demand are self-reinforcing. More drivers = lower wait times = more rider demand = more drivers, and the flywheel spins.

But there is a limit. Dropping wait times from 8 to 4 minutes provides tremendous value to riders. However, increasing the number of drivers to reduce wait times from 2 to 1 minute is significantly less valuable.

Further, there is a physical limit to the value creation that increasing supply can generate—it is impossible to go below 0 minutes of wait time. Drivers can’t pick up riders in less than 0 minutes. Eventually, increases in supply will have no impact on value flowing to demand, thus limiting the potential of their network.

2. Multi-tenanting results in price competition

Compounding Uber’s asymptotic marketplace is the low switching costs for both drivers (demand) and riders (supply), which leads to multi-tenanting.

Recall that multi-tenanting refers to when the supply side or demand side can use numerous platforms. It costs a rider nothing to switch from Uber to Lyft to another third app. Riders have all three options accessible on their smartphone and often make ride decisions based on price. The same is true for drivers, who can drive for Uber and Lyft simultaneously.

Left unaddressed, this can result in ridesharing companies facing a similar fate to airlines where margins are razor thin and consumers make carrier decisions based on price. This is not an attractive position to be in.

***

I hope this three-part series on network effects has been instructive. Network effects are some of the most powerful forces impacting our lives. [3] Having the ability to identify and understand network effects will allow founders to build them, investors to fund them, and workers to be employed by them.

Finally, this series is not the final word on network effects. As I learn more, my thoughts will change and I encourage you to dive deeper if you are interested.

Notes, Inspirations & Additional Readings

-

If you want to dig deeper, I would recommend the following sites to get you started: NFX, A16Z, Metcalfe’s Law

-

Thanks to Kerri for her review and feedback.

[1] Parts of Facebook’s success can be attributed to its brand (they started out exclusive to Harvard students, thus leveraging one of the most elite brands available) and embeddedness strategy (i.e., Facebook Connect, which lets users sign-in to their sites with their Facebook login as a form of identity authentication).

[2] This is not an exhaustive list and it is likely that I missed some network effects. But the list should cover the most powerful network effects at play.

[3] Keep an eye out for a future post on network effects and their role in our lives.